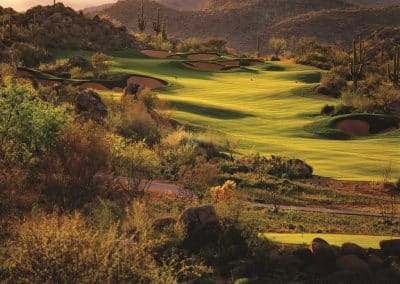

Golf courses and country clubs are at a pivot point after seeing a surge of interest. BLEND IMAGES – PBNJ PRODUCTIONS VIA GETTY IMAGES

Country clubs and golf courses are at a pivot point, and Blake Walker is banking that subscription models are the future of the industry.

The veteran hospitality executive and CEO of the privately held Arcis Golf LLC is bucking the idea that country clubs and daily-fee golf courses are inherently different.

That’s why he formed Arcis in 2014. Over the past decade, the company — with the backing of Fortress Investment Group LLC and Atairos — purchased nearly 70 clubs and has grown to about 6,000 employees.

The company now holds a roughly equal mix of daily-fee courses and private country clubs that includes several high-profile courses, including Champions Retreat Golf Club near Augusta, Georgia, a 27-hole private course designed by Jack NIcklaus, Arnold Palmer and Gary Player.

But it also includes public courses that many golfers frequent, including Angel Park Golf Club in Las Vegas and Arrowhead Golf Club in Littleton, Colorado.

Traditionally, the two concepts haven’t mixed, but Walker is betting on a future in which people can move from one to the other as their lives change — and enjoy broader access than just their own local club or course.

“My belief at Arcis’ inception (was) that there are far more commonalities than differences between daily-fee courses and private courses,” Walker said.

His goal is to create an ecosystem that includes everything from entry-level to upscale clubs in every major metro in the U.S. The company has acquired and invested $100 million in dense pockets of courses around major metros. In 2021, he told the Dallas Business Journal, his plans to double the company over the next five years, through acquisitions and organic growth

Walker’s company is seeking to disrupt traditional models at an inflection point for golf courses and country clubs alike. Many golf courses have seen a surge of business since the pandemic, while a variety of factors have led several country clubs to close their doors and contributed to rising dues at others.

SPECIAL REPORT: The State of Country Clubs

• Country clubs are at a crossroads. Some are closing. Some see a big opportunity.

• Country club dues are skyrocketing. Here’s what’s driving the trend and the outlook ahead.

• Why this CEO is bullish on country clubs — and on the hunt to buy more.

• Closed golf courses, country clubs offer high risks, big rewards for developers

Chris Davies, director at industry tracking firm Club Benchmarking, previously told The Business Journals it’s an overall healthy time for the industry — even amid some recent country club closures.

“Member counts, initiation fees have all seen positive trends recently and are having a substantial positive impact of the health of private clubs,” Davies said. “They were quite honestly a bit on the ropes before.”

For existing and prospective club members who are waiting for membership fees — or long waitlists — to settle down, they likely will have to wait a while. Country clubs have been seeing an influx of aging millennials, and the largest number of millennials were born in 1990. Since the average age of a median first-time country club joiner tends to be around 42, that means country clubs will see increasing interest through 2032, Davies said.

Arcis is seeking to carve out a niche amid those changes and opportunities.

In the Phoenix area, where the company owns 16 facilities, more than 10,000 golfers subscribe to one of three tiers of the Arcis Players monthly subscription service. Basic subscriptions give golfers access to reduced golfing fees at nine public courses throughout the region. More expensive subscriptions give players access to additional discounts on private lessons, advance tee times, free clinics and other freebies.

For the players who eventually decide to join a private country club, those experiences are more likely to keep them within the Arcis ecosystem, Walker said.

“There is some sort of content or programming every night of the week. That’s perfect for a subscription offering,” Walker said. “Rather than people leaving based upon price, they will stay within our ecosystem.”

It also means creating possibilities for people to join a private country club in one city and another Arcis club elsewhere — a factor that has become more important in the hybrid era, where members want to use facilities in different places around the country.

In 2016, Arcis began offering Arcis Access, a travel reciprocity program that allows its private club “golf members” to golf at any of the other private clubs in its portfolio.

In 2017 Arcis extended the program to include a partnership with Links2Golf which widened the overall network to 850 clubs worldwide. Only private club golf members can enroll in the program, and for an additional fee.

“Historically, it’s been ‘I joined this specific club because I enjoy playing golf.’ What we are seeing now is that people want a club that encompasses more,” Walker said.

Over time, Walker said Arcis will continue to buy clubs where it makes sense, aiming for density in major urban areas.

Arcis, the second-largest country-club organization after the acquisitive Invited Corp., is building its portfolio at a time when the wider country club industry faces a crossroads.

Some clubs have thrived from the increased attention to golf and Americans flocking to outdoor spaces during the Covid-19 pandemic, while others slowly crumbled under the weight of expensive capital repairs.

For golf courses that lay abandoned, their future is often fraught with development hurdles. For country clubs that survive and thrive, many are raising their dues and initiation fees to better handle the future.

“Golf is merely the ante in the game. The golf has got to be the foundation and be really good. But we also have to think about with a family-centric perspective,” Walker said. “I would approach it very similarly to a media company. We have to have something throughout the day that appeals to each of our consumers within that.”

To achieve that goal, the company creates family programming including exercise facilities, kid-friendly pizza-making classes and dining experiences.

Walker also sees a future for Arcis beyond country clubs and golf courses, including wellness and related areas — with golf as the flywheel that holds it together.

“I think there’s a lot of opportunity for us to expand beyond just our golf footprint,” Walker said. “There’s significant white space there for us.”

Other players in the industry are also betting on other programming to complement golf offerings.

Invited, which has approximately 180 properties and recorded about $1.7 billion in 2022 revenue, has been seeking to expand its reach with new amenities like pickleball or even e-gaming activities.

“Gaming has become the dominant form of entertainment for many, especially for younger members,” Invited CEO David Pillsbury said.

Pillsbury said those new offerings help the bottom line because parents whose children attend programs at country clubs are far more likely to renew their membership than those who don’t. It also helps take on what he views as clubs’ biggest competitor.

“We view the competition as the home. Our job is to try and get you out of the home more often and into the club,” Pillsbury said. “And that means the entire family.”

-

Over the past 10 years, Arcis Golf has grown to nearly 70 golf-related properties across the country.

-

Valencia Country Club California

-

TPC Rivers Bend Cincinnati, Ohio

-

The Stone Canyon Club Tucson, AZ

-

The Dominion Country Club San Antonio, TX

-

The Club at Weston Hills Weston, Florida

-

The Club at Ruby Hill Pleasanton, CA

-

Raven Golf Club Phoenix, AZ

-

Grayhawk Golf Club Phoenix, AZ

-

Angel Park Golf Club Las Vegas, NV

-

Arrowhead Golf Club Denver, CO

…

https://www.bizjournals.com/dallas/news/2024/01/09/golf-course-subscriptions-and-country-club.html