On August 4, 2025, the average 30‑year fixed mortgage rate dropped to 6.57%, its lowest point since October 2024, down from 6.74% just a week earlier . This shift has created a brief—but meaningful—window of opportunity for homebuyers and those looking to refinance.

What’s Driving the Dip?

What’s Driving the Dip?

- A disappointing July jobs report showed weaker job growth and a slight rise in unemployment—shaking investor confidence in the economy.

- Investors flocked to 10‑year Treasurys, pushing yields down—a key factor because mortgage rates follow those yields closely, not short-term Fed rates .

How It Impacts Buyers & Homeowners

How It Impacts Buyers & Homeowners

- A buyer with a $3,000/month budget can now afford a home priced at approximately $458,750, up from about $439,000 in May—a gain of around $20,000 in purchasing power .

- On a median‑priced home (about $447,000), the monthly mortgage payment drops from ~$2,983 to ~$2,862—over $100 in savings per month .

If you’re refinancing a $300,000 mortgage at 7.5%, switching down to 6.57% could reduce your payment by nearly $200/month—although closing costs and appraisal fees should be considered .

Timing, Opportunities & Limitations

Timing, Opportunities & Limitations

- Redfin’s chief economist Daryl Fairweather hailed the dip as a “window of opportunity to buy before summer ends”, with improved affordability and strong inventory levels giving buyers leverage .

- While homesellers still outnumber buyers—offering negotiation room—new listings are starting to decline, narrowing that gap .

-

Affordability issues persist: median home prices reached a record $435,300 in June, and mortgage rates likely stay above 6% through 2025 into 2026 unless yields fall further .

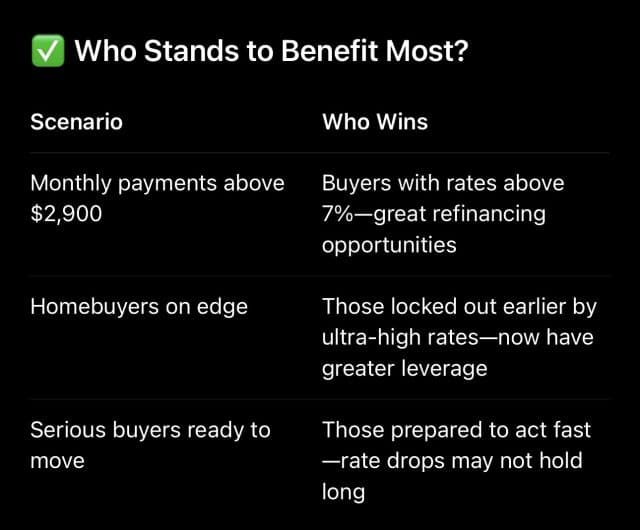

Experts emphasize that the biggest beneficiaries are homeowners with mortgage rates above 7%. Most borrowers already locked in sub‑6% rates won’t enjoy as much immediate gain .

What’s Next: Should You Jump In or Hold?

What’s Next: Should You Jump In or Hold?

Now might be the time—but be strategic:

- If you’re a refinancer with high existing rates, this dip is worth evaluating—even with closing costs.

- If you’re a well-qualified buyer, this moment unlocks extra purchasing power and potentially more bargains.

- That said, if you can afford to wait and track jobs, inflation, and Treasury yields, you may see further downward movement in rates—but there’s no guarantee.

- Inventory trends matter: as listings wane, buyer leverage could diminish.

Final Takeaways

Final Takeaways

- Mortgage rates fell to 6.57% on August 4, a 10‑month low tied to weakness in the labor market and investor flight to Treasurys.

- That drop translates to tangible savings—around $100+ per month on median-priced home payments or ~$200/month when refinancing from higher rates.

- Buyers and homeowners with above‑average rates have a rare leverage window—but affordability pressures and limited home supply persist.

- If you’re financially ready and plan to stay put, now could be the best moment to lock in a rate before summer winds down.

Whether you’re buying or refinancing, consider getting pre‑approved or pricing offers now—and act if the conditions look right before the window closes.