The housing market is becoming an increasingly complicated game for first-time home buyers. Unpredictable interest rates, inventory shortages, and affordability woes mean there’s no clear-cut, one-way route to homeownership. NAR’s latest study shows the creative strategies today’s FTHBs use to land their first house.The housing market is becoming an increasingly complicated game for first-time home buyers. Unpredictable interest rates, inventory shortages, and affordability woes mean there’s no clear-cut, one-way route to homeownership. NAR’s latest study shows the creative strategies today’s FTHBs use to land their first house.

Pathways to Ownership

In the midst of rising interest rates and low housing inventory, first-time buyers get creative to get into their first home.

Americans looking to buy their first home are facing a challenging market. In fact, only 26% of recent home purchases were made by first-time buyers, according to the National Association of Realtors®’ 2022 Home Buyers and Sellers Report. That’s an all-time low and down from 34% last year. Compare this to the historical average of 40%, or to recent highs in 2010, when a special First-time Buyer Tax Credit prompted first-time buyers to comprise a staggering 50% of all home buyers.

In the midst of challenging market conditions, many homebuyers are finding creative pathways to ownership, rethinking whom they live with, and availing themselves of underutilized financing programs to get the keys to their first house.

NAR

An Unusually Competitive Market

“This is such an unusual year,” says Dr. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®. “We started out in a low rate interest rate environment with very low housing inventory and incredible demand. And then we saw that rise in interest rates.” Because housing supply is still limited, the rising interest rates have created hurdles for anyone looking to buy a home, but as Lautz notes, potential first time home buyers are being hit particularly hard because they don’t have housing equity. (“Equity” is generally defined as the difference between what the homeowner owes and what the home is worth. In other words, it is the property’s current market value minus the amount of the mortgage an owner has already paid off.)

As frustrated millennials will tell you, they find themselves in something of a catch-22: they’re struggling to buy a house because they don’t already have home equity, but they can’t build home equity until they buy a house.

It gets trickier still. Not only are they competing for limited housing with repeat-buyers who, in many cases, are coming in with sizable equity—or cash—the current interest rates might mean that the average mortgage could run buyers as much as $1,000 per month more than it did a year ago.

As a result, people are waiting longer to buy their first homes. Indeed, this past year the average first-time buyer was 36 years old, an all-time high and an age jump of three years over last year’s data. Despite these challenges, Lautz says the data also showed some hopeful trends. “On the flip side, I thought first-time home buyers this year were pretty creative in how they entered the market.”

NAR

The More the Merrier

For millennials—the largest share of first-time homebuyers—living with roommates is a common experience. It may not be a surprise, then, that many are actually buying homes with roommates. According to the 2022 Home Buyers and Sellers Report, a full 5% of first-time buyers bought a home with individuals with whom they were not romantically involved. That is another all-time high since NAR started tracking the data. Instead of paying rent together, roommates can build equity together. The draw of buying with a friend may not be limited to sharing costs. The joys of homeownership can also be shared—not to mention the lawn mowing and dishes. It’s worth noting that buying a home with friends is not without complications and risks, so it’s important to have the right mortgage broker and to work with an agent who is a REALTOR®, a member of the National Association of Realtors. It’s also critical to consult with a legal professional to ensure that there are clear lines of ownership. If your roommate gets a job in another state—or develops an allergy to your beloved cat—it’s important to have a plan in place.

Other homebuyers were opting for different roommates: mom and dad. (Or even grandma and grandpa!) Across the board, 14% of home buyers were buying with family members for the purpose of establishing multigenerational homes. Lautz notes that an increasing number of people are opting to buy with aging parents or grandparents so that they can provide care for them—or get help caring for young children. Others are buying homes with their adult children who are finding it advantageous to move back home with their parents after college. Another factor, beyond caregiving and companionship, is the pooling of resources. Together, the multigenerational buyers can afford a home in a more desirable neighborhood or town which might have been off the table for an individual or a couple alone.

NAR

Broadening the Search

As buyers are feeling the crunch to find a home, many are looking farther afield. From 2018 to 2021, homebuyers moved a median distance of 15 miles. This year, the number jumped to 50 miles—another all-time high. Many buyers in this climate may need to look to smaller towns or an area beyond the suburbs to find a home they can afford. Or they may have to endure longer commutes for the opportunity to own instead of rent. Others, particularly after the changes wrought by the COVID-19 pandemic, may have the luxury of working from home or fewer days traveling into the office, giving them increased flexibility. Lautz notes that people are moving farther away because of affordability constraints, but “they also want to be close to friends and family, and the quality of life may be better. And so they’re choosing small towns and outer suburbs because they have to, but also because they want to.”

These days it’s also easier to look for homes outside of your local towns and neighborhoods. NAR found that 96% of buyers used online search tools. But even if you find attractive options, finding time to look at several houses that are dozens of miles away can be a challenge. So while buyers looked at a median of nine homes, four of those nine were online-only viewings, on average. For one in ten buyers over the past year, looking at the home online was enough to purchase the house sight unseen. Naturally, having a real estate professional who can be physically present at the home is more important than ever, particularly if the house is a “fixer-upper.” That way, the only surprise is the good kind: finding a great house for an affordable price.

NAR

Mortgage Assistance Programs

Moving outside of urban centers has advantages beyond more affordable housing. Buyers may be able to take advantage of a mortgage from the USDA’s Rural Development program, which allows select buyers to purchase a home with no money down. A year ago, buyers using federal- or state-backed mortgage products might have had difficulty competing in the red-hot marketplace, where they would lose out to repeat buyers coming in with more equity or all-cash bids. As Lautz points out, it might actually be an ideal time for buyers using loan programs to look for property because there’s slightly less competition.

First time buyers might be able to avail themselves of a FHA loan, a mortgage backed by the federal government that has lower minimum down payments than traditional mortgage products. On a local level, individual states have programs and incentives that can help first-time buyers get a mortgage. “Those programs are largely underutilized and do fly under the radar,” Lautz remarks. “ A lot of local communities even have options.” Of course, most buyers—whether first-time or repeat—aren’t experts at wading through government mortgage programs. The good news is that they don’t need to be. The trick, Lautz says, is partnering with “a good mortgage broker who will be able to find you low down payment programs.”

NAR

Creative Financing

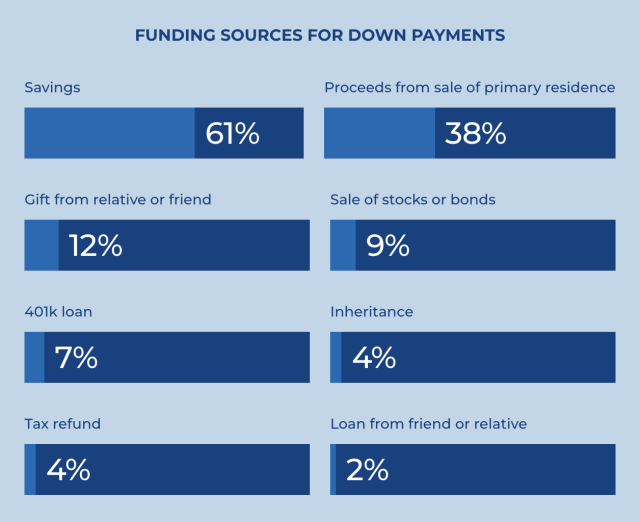

When it comes to financing the down payment, a mortgage assistance program may just be one piece of the puzzle. “Home buyers are finding they need to become more creative,” Lautz says, “than the traditional bread and butter of ‘I will save for an X period of time, and then I will buy my first home’.” Putting together the rest of the puzzle may require pulling from different sources. For instance, a first time buyer might put a downpayment by drawing on a combination of savings, a 401k loan, stock sales, and a gift from a relative. 1% of recent buyers even used cryptocurrency to help finance their mortgage.

NAR

No matter how you finance your down payment, first-time buyers will still find a challenging housing market awaits them. But they can better equip themselves for success by educating themselves and working with experts. A good mortgage broker can find competitive rates or underutilized assistance programs, and the expertise of a REALTOR®, who follows a code of ethics, can identify overlooked areas, and help you understand the bidding landscape. The good news is that though it might take a bit longer for first time buyers to find a house, it is still possible. “I think that there’s a lot of potential first time home buyers and renters who are really discouraged right now,” Lautz says. “And I just hope that they hold onto that dream of home ownership because, if you work with those experts, they’ll try and help you get there—perhaps sooner than you imagined you could.”

…

Source: https://sponsorcontent.cnn.com/interactive/nar/pathways-to-ownership/?utm_campaign=Homeward%20Bound&utm_medium=email&_hsmi=248537906&_hsenc=p2ANqtz-_9PFDIU3wokxvaveN6FFeSN_Dm3zvfUR_A4Tf0qFz-Od3RLUo5QfWHqMy60PBNkpWOLG9r_xhbLICtpqAPVfItypK79Q&utm_content=248537906&utm_source=hs_email